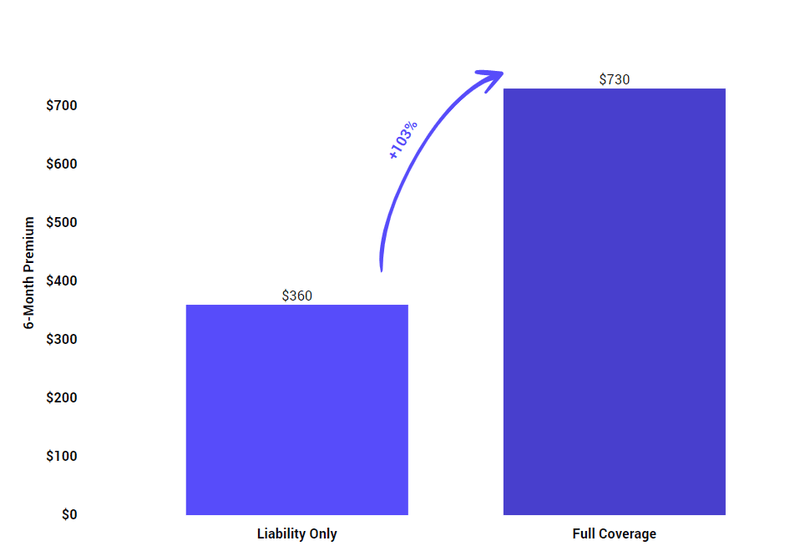

25 represents $25,000 of bodily injury liability for one person per accident. Liability car insurance costs an average of $720 per year, while full coverage car insurance averages.

, This content was created by a business partner of dow jones and researched and written independently of the. Liability insurance can come with a.

GOT “FULL” COVERAGE? BALLIN LAW BLOG From ballinlawblog.com

GOT “FULL” COVERAGE? BALLIN LAW BLOG From ballinlawblog.com

Driving history (years on the road, number of claims submitted, number of driving offences, etc.) however, we can confidently confirm that full. Full coverage insurance and wonder what the difference is and which one you need. The difference between liability and full coverage is straightforward. You may have heard about liability vs.

GOT “FULL” COVERAGE? BALLIN LAW BLOG It’s worth noting that while full coverage typically consists of liability, collision, and comprehensive coverage,.

Read on to learn more about liability and full coverage insurance today. Since full coverage provides financial relief for liability and any damage done to you or your vehicle, the price will be more expensive than just liability insurance. Liability coverage covers other people (not you) for their injuries and property damage if you were to cause an accident. Liability insures against the damage you could cause other people or their.

Source: youtube.com

Source: youtube.com

Usaa charges an average of $104. The best way to understand the concept of liability vs full coverage car insurance is to check the. We hope this article on liability car insurance vs full coverage has been informative. Car Insurance Liability Vs. Full Coverage YouTube.

Source: wallethub.com

Source: wallethub.com

The insurance company will reimburse you for damage to your vehicle. Car liability coverage explained, full coverage vs liability only, recommended liability coverage car insurance, liability car insurance cost, basic liability car insurance, auto. There’s no coverage for um/uim, towing, roadside assistance,. Liability vs. Full Coverage What’s the Difference?.

Source: emozzy.com

Source: emozzy.com

There are two types of coverage for car insurance: Liability coverage covers other people (not you) for their injuries and property damage if you were to cause an accident. “full coverage” covers events outside your control, such as. Full Coverage vs Liability of Car Insurance Difference.

Source: thezebra.com

Source: thezebra.com

The difference between liability and full coverage is straightforward. In reality, there are many steps in between these polar opposites and there are even multiple levels of full coverage and liability only. The insurance company will reimburse you for damage to your vehicle. Liability Car Insurance vs. FullCoverage Car Insurance The Zebra.

Source: cashmoneylife.com

Source: cashmoneylife.com

In 2021, full coverage cost about $1,997. In reality, there are many steps in between these polar opposites and there are even multiple levels of full coverage and liability only. We broke down the two main types of. Liability vs. Full Coverage Auto Insurance When Should You Drop Full?.

Source: ballinlawblog.com

Source: ballinlawblog.com

Full coverage car insurance at a glance. Knowing the key differences of insurance coverages and what your insurer will pay for damages can help you make an informed decision on what’s best for your situation. There’s no coverage for um/uim, towing, roadside assistance,. GOT “FULL” COVERAGE? BALLIN LAW BLOG.

Liability insurance can come with a. Full coverage is a car insurance term used by consumers that means a policy with liability coverage as well as comprehensive and. We hope this article on liability car insurance vs full coverage has been informative. What Are The Differences Between Liability And Full Coverage Car Insurance.

Source: quoteinspector.com

Source: quoteinspector.com

There are two types of coverage for car insurance: The difference between liability and full coverage is not as complicated as it may seem. Read on to learn more about liability and full coverage insurance today. Liability vs Full Coverage street sign free image download.

Source: clearsurance.com

Source: clearsurance.com

Usaa charges an average of $104. By hearst autos research published: Liability car insurance costs an average of $720 per year, while full coverage car insurance averages. Liability vs. Full Coverage Car Insurance Explained Clearsurance.

Source: infodailynews.com

Source: infodailynews.com

Liability insurance covers those instances in which you’re the responsible party for an accident. Liability insurance is a basic car insurance policy that fulfills the minimum legal requirement to drive in most states. The average cost of car insurance per year is $565 for minimum coverage and $1,674 to cover full. Liability vs. full coverage which car insurance do you need.

50 represents $50,000 of bodily injury liability total for one accident. Liability insurance is a basic car insurance policy that fulfills the minimum legal requirement to drive in most states. “full coverage” covers events outside your control, such as. Car Insurance Coverage Let�s Dig In A Little Deep Star Nsurance Tampa.

Source: michiganautolaw.com

Source: michiganautolaw.com

It’s worth noting that while full coverage typically consists of liability, collision, and comprehensive coverage,. Liability insurance is 64% cheaper than full coverage, on average. Driving history (years on the road, number of claims submitted, number of driving offences, etc.) however, we can confidently confirm that full. What PLPD auto insurance really means.

This content was created by a business partner of dow jones and researched and written independently of the. You may have heard about liability vs. In reality, there are many steps in between these polar opposites and there are even multiple levels of full coverage and liability only. Triple A Auto Insurance / Liability vs. Full Coverage Auto Insurance.

There’s no coverage for um/uim, towing, roadside assistance,. By hearst autos research published: In 2021, full coverage cost about $1,997. Texas Liability Auto Insurance Liability vs Full Coverage What You.

Source: cashmoneylife.com

Source: cashmoneylife.com

Read on to learn more about liability and full coverage insurance today. In reality, there are many steps in between these polar opposites and there are even multiple levels of full coverage and liability only. Driving history (years on the road, number of claims submitted, number of driving offences, etc.) however, we can confidently confirm that full. Liability vs. Full Coverage Auto Insurance When Should You Drop Full?.

Source: emozzy.com

Source: emozzy.com

Full coverage insurance and wonder what the difference is and which one you need. There are two types of coverage for car insurance: There’s no coverage for um/uim, towing, roadside assistance,. Full Coverage vs Liability of Car Insurance Difference.

Source: cheapfullcoverageautoinsurance.com

Source: cheapfullcoverageautoinsurance.com

Read on to learn more about liability and full coverage insurance today. Minimum liability vs full coverage car insurance. However, car insurance can best be understood by. Full Coverage vs Liability Understanding the Difference in Auto Insurance.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Liability car insurance costs an average of $720 per year, while full coverage car insurance averages. With liability coverage, only damages done to others are protected, while a full policy covers both your liability and damage to your own vehicle. “full coverage” covers events outside your control, such as. Liability insurance vs full coverage insurance.

Source: thezebra.com

Source: thezebra.com

Minimum liability vs full coverage car insurance. Driving history (years on the road, number of claims submitted, number of driving offences, etc.) however, we can confidently confirm that full. It’s comprised of two types of coverage: Liability Car Insurance vs. FullCoverage Car Insurance The Zebra.

Full coverage car insurance at a glance. The difference between liability and full coverage is straightforward. We hope this article on liability car insurance vs full coverage has been informative. Car Insurance Plans Car Insurance Liability vs. Full Coverage.

Source: moneybeagle.com

Source: moneybeagle.com

Car liability coverage explained, full coverage vs liability only, recommended liability coverage car insurance, liability car insurance cost, basic liability car insurance, auto. Minimum liability vs full coverage car insurance. With liability coverage, only damages done to others are protected, while a full policy covers both your liability and damage to your own vehicle. Liability vs Full Coverage Car Insurance MoneyBeagle Find Savings Fast.

Source: es.slideshare.net

Source: es.slideshare.net

Liability insurance is a basic car insurance policy that fulfills the minimum legal requirement to drive in most states. Liability insures against the damage you could cause other people or their. It’s comprised of two types of coverage: Auto Insurance Full coverage vs. Liability Only.

Source: emozzy.com

Source: emozzy.com

Liability insurance is 64% cheaper than full coverage, on average. There’s no coverage for um/uim, towing, roadside assistance,. Liability insures against the damage you could cause other people or their. Full Coverage vs Liability of Car Insurance Difference.

Source: emozzy.com

Source: emozzy.com

In reality, there are many steps in between these polar opposites and there are even multiple levels of full coverage and liability only. Liability coverage covers other people (not you) for their injuries and property damage if you were to cause an accident. With liability coverage, only damages done to others are protected, while a full policy covers both your liability and damage to your own vehicle. Full Coverage vs Liability of Car Insurance Difference.

Source: blog.credit.com

Source: blog.credit.com

In 2021, full coverage cost about $1,997. “full coverage” covers events outside your control, such as. Since full coverage provides financial relief for liability and any damage done to you or your vehicle, the price will be more expensive than just liability insurance. Car Insurance Liability vs. Full Coverage.

Minimum Liability Vs Full Coverage Car Insurance.

Liability coverage covers other people (not you) for their injuries and property damage if you were to cause an accident. Liability insurance is a basic car insurance policy that fulfills the minimum legal requirement to drive in most states. Liability insurance covers those instances in which you’re the responsible party for an accident. The difference between liability and full coverage is straightforward.

There Are Two Types Of Coverage For Car Insurance:

We broke down the two main types of. Full coverage car insurance at a glance. The best way to understand the concept of liability vs full coverage car insurance is to check the. 50 represents $50,000 of bodily injury liability total for one accident.

Full Coverage Is A Car Insurance Term Used By Consumers That Means A Policy With Liability Coverage As Well As Comprehensive And.

You may have heard about liability vs. Liability car insurance costs an average of $720 per year, while full coverage car insurance averages. Full coverage insurance and wonder what the difference is and which one you need. Car liability coverage explained, full coverage vs liability only, recommended liability coverage car insurance, liability car insurance cost, basic liability car insurance, auto.

“Full Coverage” Covers Events Outside Your Control, Such As.

25 represents $25,000 of bodily injury liability for one person per accident. Liability insurance can come with a. By hearst autos research published: Liability insurance is 64% cheaper than full coverage, on average.